It is fair to say that 2020 was a challenging year with wide-ranging effects, including significant effects on our ongoing efforts to ensure food integrity and prevent fraud in the food system. COVID-19 caused major supply chain disruptions for foods and many other consumer products. It also highlighted challenges in effective tracking and standardization of food fraud-related data.

Let’s take a look at some of the notable food fraud occurrences in 2020:

- Organic Products. The Spanish Guardia Civil investigated an organized crime group that sold pistachios with pesticide residues that were fraudulently labeled as organic, reportedly yielding €6 million in profit. USDA reported fraudulent organic certificates for products including winter squash, leafy greens, collagen peptides powder, blackberries, and avocados. Counterfeit wines with fraudulent DOG, PGI, and organic labels were discovered in Italy.

- Herbs and Spices. Quite a few reports came out of India and Pakistan about adulteration and fraud in the local spice market. One of the most egregious involved the use of animal dung along with various other substances in the production of fraudulent chili powder, coriander powder, turmeric powder, and garam masala spice mix. Greece issued a notification for a turmeric recall following the detection of lead, chromium, and mercury in a sample of the product. Belgium recalled chili pepper for containing an “unauthorized coloring agent.” Reports of research conducted at Queen’s University Belfast also indicated that 25% of sage samples purchased from e-commerce or independent channels in the U.K. were adulterated with other leafy material.

- Dairy Products. India and Pakistan have also reported quite a few incidents of fraud in local markets involving dairy products. These have included reports of counterfeit ghee and fraudulent ghee manufactured with animal fats as well as milk adulterated with a variety of fraudulent substances. The Czech Republic issued a report about Edam cheese that contained vegetable fat instead of milk fat.

- Honey. Greece issued multiple alerts for honey containing sugar syrups and, in one case, caramel colors. Turkey reported a surveillance test that identified foreign sugars in honeycomb.

- Meat and Fish. This European report concluded that the vulnerability to fraud in animal production networks was particularly high during to the COVID-19 pandemic due to the “most widely spread effects in terms of production, logistics, and demand.” Thousands of pounds of seafood were destroyed in Cambodia because they contained a gelatin-like substance. Fraudulent USDA marks of inspection were discovered on chicken imported to the United States from China. Soy protein far exceeding levels that could be expected from cross contamination were identified in sausage in the Czech Republic. In Colombia, a supplier of food for school children was accused of selling donkey and horse meat as beef. Decades of fraud involving halal beef was recently reported in in Malaysia.

- Alcoholic Beverages. To date, our system has captured more than 30 separate incidents of fraud involving wine or other alcoholic beverages in 2020. Many of these involved illegally produced products, some of which contained toxic substances such as methanol. There were also multiple reports of counterfeit wines and whisky. Wines were also adulterated with sugar, flavors, colors and water.

We have currently captured about 70% of the number of incidents for 2020 as compared to 2019, although there are always lags in reporting and data capture, so we expect that number to rise over the coming weeks. These numbers do not appear to bear out predictions about the higher risk of food fraud cited by many groups resulting from the effects of COVID-19. This is likely due in part to reduced surveillance and reporting due to the effects of COVID lockdowns on regulatory and auditing programs. However, as noted in a recent article, we should take seriously food fraud reports that occur against this “backdrop of reduced regulatory oversight during the COVID-19 pandemic.” If public reports are just the tip of the iceburg, 2020 numbers that are close to those reported in 2019 may indeed indicate that the iceburg is actually larger.

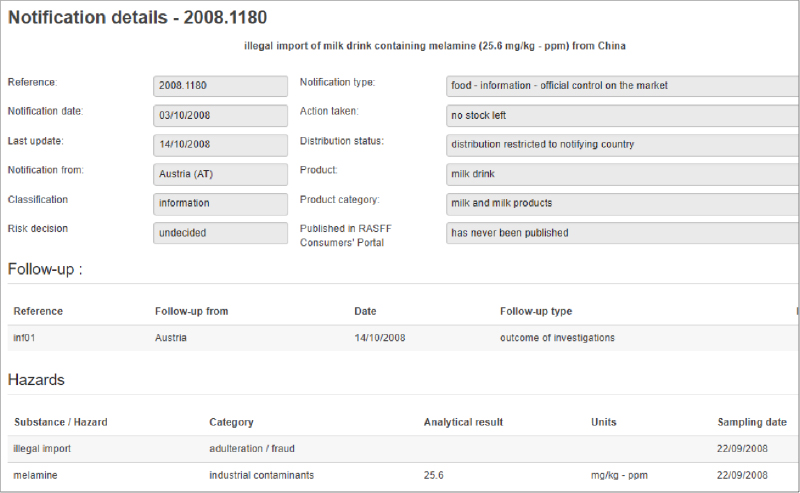

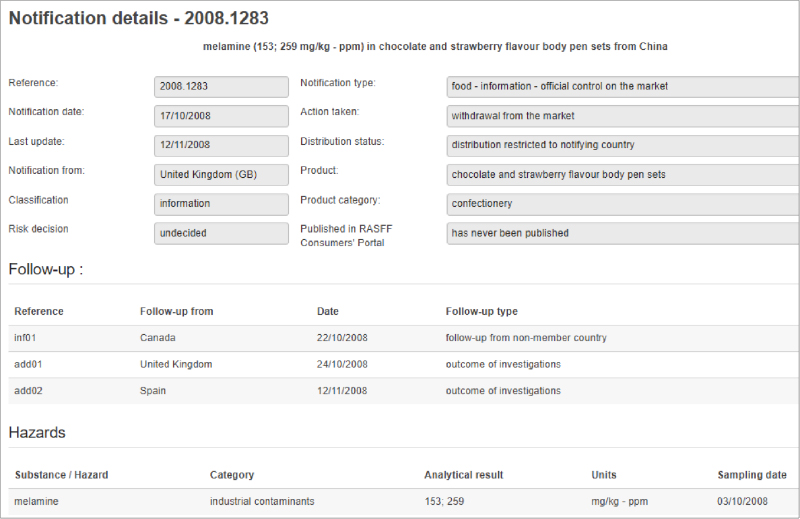

Unfortunately, tracking food fraud reports and inferring trends is a difficult task. There is currently no globally standardized system for collection and reporting information on food fraud occurrences, or even standardized definitions for food fraud and the ways in which it happens. Media reports of fraud are challenging to verify and there can be many media reports related to one individual incident, which complicates tracking (especially by automated systems). Reports from official sources are not without their own challenges. Government agencies have varying priorities for their surveillance and testing programs, and these priorities have a direct effect on the data that is reported. Therefore, increases in reports for a particular commodity do not necessarily indicate a trend, they may just reflect an ongoing regulatory priority a particular country. Official sources are also not standardized with respect to how they report food safety or fraud incidents. Two RASFF notifications in 2008 following the discovery of melamine adulteration in milk illustrate this point (see Figure 1). In the first notification for a “milk drink” product, the hazard category was listed as “adulteration/fraud.” However, in the second notification for “chocolate and strawberry flavor body pen sets,” the hazard category was listed as “industrial contaminants,” even though the analytical result was higher.1

What does all of this mean for ensuring food authenticity into 2021? We need to continue efforts to align terminology, track food fraud risk data, and ensure transparency and evaluation of the data that is reported. Alignment and standardization of food fraud reporting would go a long way to improving our understanding of how much food fraud occurs and where. Renewed efforts by global authorities to strengthen food authenticity protections are important. Finally, consumers and industry must continue to demand and ensure authenticity in our food supply. While most food fraud may not have immediate health consequences for consumers, reduced controls can lead to systemic problems and have devastating effects.

Reference

- Everstine, K., Popping, B., and Gendel, S.M. (2021). Food fraud mitigation: strategic approaches and tools. In R.S. Hellberg, K. Everstine, & S. Sklare (Eds.) Food Fraud – A Global Threat With Public Health and Economic Consequences (pp. 23-44). Elsevier. doi: 10.1016/B978-0-12-817242-1.00015-4