The FDA will officially implement a new food traceability rule on November 7, 2022. While the new rule requires a detailed account of food’s origin and movements throughout production, processing and shipping, the food industry still lacks international standardized guidelines that factor in countries’ varying health and agricultural priorities. As this continues to be one of the global food system’s biggest challenges, we spoke with Sara Bratager, Food Traceability & Food Safety Scientist at the Institute of Food Technologists, to discuss where the food industry stands currently, and opportunities to establish a global standard that is mutually beneficial (and achievable) for all.

The FDA is scheduled to finalize new FSMA traceability rule on November 7. What are some of the key changes that food manufacturers and suppliers will need to address with the new rule?

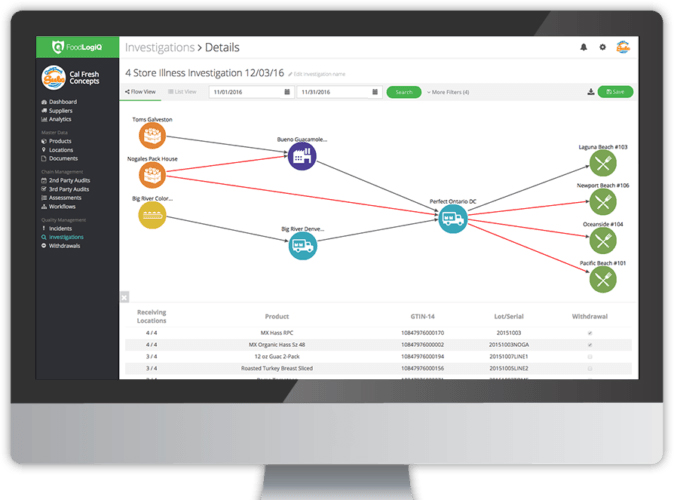

Bratager: The finalized rule will be published in November. Based on the proposed rule, it will go into effect in January 2023 (60 days after publication) and companies will have two years after that to make any adjustments needed to achieve compliance. Entities that produce, process, ship or receive any of the products on the Food Traceability List will need to capture and store the established Key Data Elements (KDEs) at each of the Critical Tracking Events (CTEs) relevant to their operation. The rule will also require companies to provide electronic traceability information to the FDA no more than 24 hours after a request is made, necessitating a significant transition from traditional paper-based traceability systems.

How prepared is the food industry to implement these changes?

Bratager: Preparedness differs throughout the food industry; some industry actors have been preparing since the release of the proposed rule, while others have chosen to forgo significant effort pending finalization of the rule. Some entities may have even engaged in unintentional preparation; companies or commodities that have been the subject of repeated recalls and subsequent traceability initiatives will likely find themselves better prepared than traceability newcomers. The food tech industry is prepared to deliver digital traceability solutions that facilitate compliance among supply chain actors, but implementation is likely to be a challenge for many. Some operations will achieve compliance with minimal disruption, whereas others will face a more burdensome effort.

How will this affect companies working with global suppliers?

Bratager: The proposed rule covers any ingredients or foods on the Food Traceability List that may be sourced from global suppliers. One of the biggest challenges for companies working with global suppliers will be coordination and communication between supply chain partners. Some companies may find themselves responsible for educating their international trading partners on FSMA requirements. However, understanding will not guarantee compliance. Some global suppliers are already reporting traceability data for domestic or other export requirements and will be hesitant to take on the burden of yet another traceability scheme. The increasingly globalized nature of our food system highlights the need for traceability standards that streamline data collection and reporting efforts through the supply chain.

Are there any efforts underway to develop global standards related to food traceability?

Bratager: Several standards exist currently. The International Organization for Standardization’s ISO 22005:2007 details basic requirements for the design and implementation of food/feed traceability systems at an organizational level. GS1, the organization best known for barcodes, provides several foundational standards for the identification, capture and sharing of data; their EPCIS standard that allows disparate applications to create and share traceability event data is particularly relevant.

Food operations are incredibly unique, and widespread standards uptake will likely require a degree of customization, which is why sector or commodity-specific efforts that build upon existing foundational standards are so important. The Global Dialogue on Seafood Traceability (GDST) provides a great example with their GDST 1.1 Standard for interoperable seafood traceability that is built upon GS1 foundations. A second example is the Produce Traceability Initiative (PTI).

How can the industry and regulators move toward developing a global standard for traceability in the food industry?

Bratager: A necessary first step is alignment around the definition of traceability. Regulatory agencies and industry actors across the globe adhere to different definitions but cohesive, global progress will require alignment around a common definition for traceability.

Industry can support the creation and uptake of pre-competitive, commodity-based traceability initiatives that drive adopters toward common practices and data standardization. Interoperability must also be prioritized. Demand for interoperable data sharing will necessitate and incentivize widespread adoption of data standards.