Frozen food demand has skyrocketed. Although COVID-19 was a catalyst, there are many reasons why the trend will likely continue going forward. The pandemic forced people to eat at home more, which was largely responsible for the hike in food sales, especially frozen goods. Higher availability and food quality enhancements have also contributed to the spike, prompting suppliers to upgrade and expand cold storage warehouse solutions—whether that means creating extra space or utilizing existing space more effectively.

One of the more important changes, prioritized across the industry, is food preservation and safety. It has always been crucial that frozen food reaches its destination clean, healthy and still frozen — just as it went in. However, preliminary data from the CDC’s Foodborne Diseases Active Surveillance Network reveals that foodborne illnesses are up 15%. The primary or most common form is Salmonella, but COVID-19 has consumers and food safety professionals thinking more closely about cleanliness and proper sanitation.

It has pushed a tight focus on safety overall, with new innovations looking to enhance sector controls.

Necessity Breeds Creativity

Recent events have played a role in the industry’s continued focus on safety, but so have consumer demands, as more and more people look to frozen meals, foods and items as part of their normal routines.

People love convenience. But as the pandemic hit, and people were forced to isolate and remain home more, and restaurants and stores closed as a safety precaution. What was once about convenience became even more about safety. People still wanted freedom and ease of use, but it wasn’t a necessity nor was it a priority. Safety became even more important, which is why curbside pickup, deliveries and online transactions became so popular.

What does this have to do with frozen foods? Everything. Because of the pandemic, we’ve all had to eat at home more often, which means preparing meals, snacks and other items, with minimal exposure to the outside world or even local grocery stores. Naturally, consumers turned to easily cooked and pre-prepared frozen foods and meals.

Safety is the Priority

It makes sense that more frozen foods being purchased and consumed would shift priorities in the market. In a 2021 report released by Acosta, 14% of respondents say they consume frozen food nearly all the time. About 46% say they consume frozen foods often.

During the pandemic, the share of U.S. core frozen food consumers rose to 39% in 2020, up from 35% in 2018. “Core” consumers are defined as those who either eat frozen food daily or every few days.

What’s more, 42% of households that buy frozen foods did so online, up from 23% in 2018. And online frozen food sales jumped 75% last year, with the top purchases including frozen dinners and entrees, meat, poultry and even seafood.

Instead of restricting eating habits, consumers have turned to frozen foods to spruce up their meals, create new at-home dishes, and so on. It has boosted the demand for all kinds of frozen foods. It also necessitates the need for improved quality and safety. Implementing and maintaining strict controls as to how the food is transported, handled and preserved, can prevent contamination on all fronts.

With that rise in dependence, on frozen foods specifically, it is imperative that supply chain operators are delivering goods in a safe, healthy condition. Allowing foods to thaw during the transport process can introduce more problems than just contamination, especially with COVID remaining a major influence.

Imagine how bad it would be if the world experienced a major foodborne outbreak, right now. Most scenarios can be prevented through smarter food handling and better, data-driven controls.

New methods are being implemented to chill and prepare foods earlier on in the supply process. Many cold chain providers are adopting low-temperature chillers, like a food processing chiller, for example. They can freeze prepared foods quickly to ensure they are safe, disinfected and stored appropriately. From there, it’s just a matter of keeping them cold-locked during transport, storage, delivery, and beyond. That’s precisely where some of the latest innovations come into the picture.

Cold Storage Warehouse Innovations

To keep up with the demand and ensure frozen foods and other goods stay fresh in the cold chain, the industry is seeing rampant innovation, thanks to modern technologies. Think IoT-equipped fleets and storage systems to facilitate faster time to market and better transparency. Or, machine learning and AI-driven tools that help discern bottlenecks, locate faster and more effective solutions, and so on.

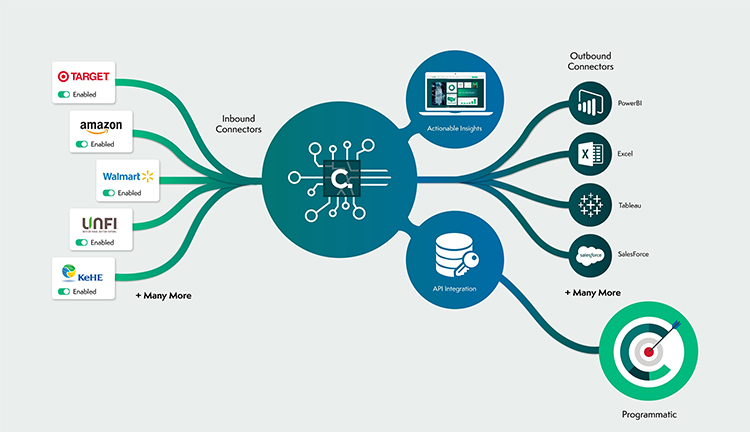

At the heart of it all is data, or rather digital content and information. The smarter and more contextually driven operations are, the better efficiency is all around. The following are some of the technologies making this happen:

- IioT. The Industrial Internet of Things (IIoT) involves connected devices that continually collect, transmit and sometimes process performance and contextual data. In the cold chain, it can be used to track goods, prevent theft or fraud, monitor processes, discover bottlenecks and more.

- Machine Learning. An offset of artificial intelligence, machine learning and neural networks can be used to ingest and analyze massive swarms of data in ways, and at speeds, that humans never could. What’s more, the technology can empower highly advanced automation systems to take action, respond, or act based on algorithmic rulesets.

- Electric and autonomous vehicles. Revolutionizing logistics and conventional transport, electric and fully autonomous vehicles will significantly improve fleets with better safety, stop-free trips and more.

- Smart shelving. Imagine Amazon’s Kivo bots, or something similar, implemented within cold storage warehouses. The entire system is designed to improve inventory management, order picking, and general logistics.

- Co-bots. Beyond delivery, ground-based drones or advanced robots can be used to transport and move heavy goods, large or bulk orders, and organize the warehouse. When outfitted with the appropriate hardware, they can reach high shelves and storage areas or move through hazardous locations, improving safety for manual workers.

Innovation Brings New Challenges

Of course, there are the general challenges facing the cold storage industry, such as how to keep foods fresh throughout the journey, proper packaging solutions, and maintaining more sanitary conditions, but there are new challenges presented by the adopted technologies.

For example, IIoT devices aren’t typically designed to be exposed to extremely frigid temperatures, which may sometimes affect the measurements and data collected. A malfunctioning device can lead to serious problems, especially when it’s the sole method for maintaining temperatures and ensuring food is properly stored.

Bringing these devices up to a sufficiently resistant level is a challenge, as is keeping them running optimally. Failing to do so could increase food contamination, the spread of foodborne illness, or worse.

Another challenge involves the expansion or development of new cold storage facilities. As warehouses and locations grow to accommodate larger inventories, the cold storage systems must become more sophisticated and powerful. What’s more, even the slightest temperature drop because of a system failure can have sweeping repercussions in such a large facility. A single refrigeration unit going down can drop temperatures across the entire warehouse.

Designing smarter spaces to keep the cold temperatures contained is one solution. Installing the supporting systems is another, which keeps things operational even when a negative scenario plays out. Automation and smart, data-driven technologies can be incredibly helpful in this area.

Finally, the bigger the cold storage solution, the higher the power draw and the more resources needed to keep things running. In turn, it’s necessary to install and implement smart technologies to reduce the carbon footprint. Cutting energy usage wherever possible becomes vital to sustainability. It can call for solutions like smart or timed lighting, smart thermostats for the refrigeration units, or upgraded systems that reduce emissions — think electric fleets and renewable energy platforms.

Backup solutions are even a part of the mix, when power outages can bring an entire operation down in seconds, and expose food to long-term risk.

Frozen Food Demand: A Steady Climb

Things may change, and there are never any guarantees, but right now it looks as though high demand for frozen food will continue, and may even grow steadily. Market conditions are partly responsible, but consumers are now more focused on quality and healthy foods, above eating out or ordering in. As the economy continues to open, people will want to get back out there and explore. But that doesn’t necessarily mean frozen food demand will decline.

Cold chain and cold storage warehouse providers must be prepared for the continued growth, which includes finding new and innovative ways to preserve, package and safely store frozen foods.