Last month, federal authorities enacted a recall process for all Real Water brand products from AffinityLifestyles.com Inc., as a result of a fatality and multiple illnesses that might be linked to the product. In addition to the recall, there are a number of court orders being enacted to retrieve records, documentation and other information from the company. The product in question is bottled water that is chemically treated to enhance its “benefits.”

Over the last 20 or so years, as with many other food and beverage categories, the bottled water market has exploded. It began with Natural Spring Waters, then emerged into what was termed “purified waters.” Over time, carbonation and flavors, both natural and imitation, were added to enhance the products’ appeal to different demographics and to capture market share. The trend has continued to illustrate how both SKU proliferation and catering to the changing needs of the consumer has complicated the industry and made it increasingly complex. Complexity, of course, adds risk.

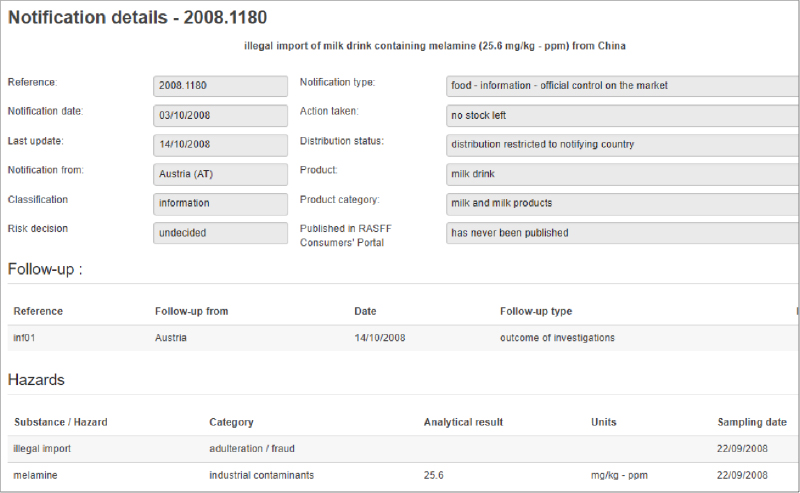

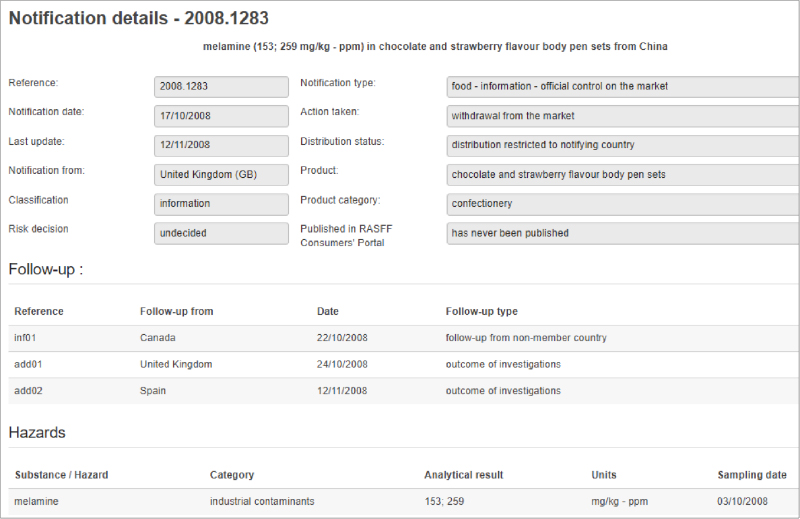

The Real Water situation brings to light potential issues both for the bottled water segment and for the food and beverage manufacturing industry on the whole. Beverage and food products often utilize additives to enhance flavor, add nutritional benefits, etc. In addition to these additives, many food and beverage products are produced with “reactionary” processes that claim to supercharge, enhance, and/or re-engineer something to a so-called better state. Government regulators monitor these processes to ensure that they do not cause health risks. Enhanced and more stringent labeling laws were enacted at the end of the Obama era and just recently, President Biden signed the FASTER Act that requires manufacturers to list sesame on their labels, as it is now a known allergen. In addition to additives, regulatory agencies monitor the new chemical and reactionary processes used in producing products to ensure that the integrity and safety of these products are not put at risk.

Lessons Learned from the Real Water Recall

Where does the industry go from here, and what lessons can manufacturers take away from the Real Water incident and from the increasingly complex state of food and beverage manufacturing? First, we know regulations will continue to increase, especially as incidents become more commonplace. The industry has been on high alert since the outbreak of COVID-19. Governments and industry will continue to try to determine if the virus can in fact be transmitted through food or food packaging. As food manufacturers experiment with plant-based food alternatives, employ new technologies and react to recalls, they should prepare for continued scrutiny and regulations which will impact how businesses are run.

The question that needs to be answered is: What should food and beverage manufacturers do to prepare for future changes to regulations and prevent potential safety issues?

The answer is: They should implement a quality management system and related business processes and systems tailored for the unique challenges of their industry.

F&B Manufacturers Can Improve Quality Systems to Prepare for Future Regulation and Safety Changes

Many manufacturers already have parts of this system and the processes in place, but it is surprising how many have not integrated them with their other systems. If we use the Real Water issue as a case study, there are a number of things that a manufacturer needs to do from a quality perspective in terms of processes, procedures and systems.

Traceability. Accuracy and timing is critical in the face of any recall. Track and traceability functionality built into the central manufacturing and/or quality system is an absolute must. Technology is available to visually track and trace every lot that goes out the door, whether from a company facility or a co-packer, and note where in the market it has been distributed.

Document Control. The government demanded that AffinityLifestyles.com Inc. turn over all documentation related to its products’ ingredients, processes, etc. Manufacturers need to ensure their document management systems include food safety precautions and that all process and product information needs to be in place.

Product and Process Change Management. Integrating inspection processes with control plans ensures that inspection requirements stay connected during change management. This coupled with non-conformance creation based on inspection failures results in reductions in the cost, time and complexity of change management.

Audit Processes. To comply with ever-changing regulations, effective internal audit programs must be implemented to drive compliance and continual improvement. A closed-loop system should address product, process and system audits to help manage any findings of non-conformance prior to external audits and to allow for corrective actions to be implemented before an issue arises.

Supplier Quality Management. Food safety issues can often be due to a material or food ingredient issue. Monitoring all activities with suppliers by requiring and instituting best practices can help ensure supplier conformance.

Ensuring Ongoing Success and Profitability for F&B Manufacturers

All businesses operate to make money. Food and beverage manufacturers are no exception. But, when the products being made are consumables, the top priorities have to be safety, quality and food integrity. The food and beverage market is changing and evolving. Due to increasing customer demand, consumer preferences, sustainability initiatives and government regulations, manufacturers face more pressure to improve quality. These market changes have resulted in faster life cycles, shorter lead times, and the need for manufacturers to deliver more products faster than before, which puts pressure on the entire organization. Manufacturers in the food and beverage industry are under intense scrutiny to consistently produce safe food. Occasionally, issues occur that are out of a manufacturer’s control, but the producers of food and beverage products still have a responsibility to ensure that all precautions are in place to meet the safety needs of the end consumer. Efficient processes and systems to manage food safety not only meet the required compliance requirements but are a huge step in ensuring ongoing success and profitability.