End-to-end traceability technology across the food and beverage (F&B) supply chain has many benefits for companies at all nodes of the chain, not least of which is the ability to act to prevent problems such as irreversible damage, loss, and theft. For these technologies to best deliver on their promise, however, they need standardized and quality-assured data. F&B supply chain stakeholders need to take steps to achieve effective data management to truly take advantage of the benefits of traceability and real-time monitoring technologies.

Since FSMA was introduced in 2011, actors across the F&B supply chain have had to change their behavior. Prior to FSMA, companies tended to react to events; today, proactive and preemptive measures are the norm. This is in line with what the legislation was designed to do: Encourage the prevention of foodborne illness instead of responding after their occurrance.

F&B manufacturers and distributors rely on technology to help predict potential obstacles and mitigate issues along their supply chains. But expressing a desire to embrace technologies such as real-time monitoring solutions and predictive analytics isn’t enough to achieve ultimate supply chain efficiency. Only by taking the necessary steps can companies get on track to ensure results.

Any company that is thinking about deploying a traceability solution has a lot to consider. Foremost, data must be digitized and standardized. This might seem challenging, especially if you’re starting from scratch, but it can be done with appropriate planning.

Let’s examine what F&B companies stand to gain by adopting new, innovative technologies and how they can successfully maximize data to achieve end-to-end supply chain traceability.

New Technologies Hold Huge Potential for F&B Supply Chains

The advantages of adopting new technologies far outweigh the time and effort it takes to get up and running. To smooth the process, F&B companies should work with solution providers that offer advisory services and full-service implementation. The right provider will help define your user requirements and create a template for the solution that will help ensure product safety and compliance. Furthermore, the right provider will help you consider the immediate and long-term implications of implementation; they’ll show you how new technologies “future-proof” your operations because they can be designed to perform and adapt for decades to come.

Burgeoning technologies such as the Internet of Things (IoT), artificial intelligence (AI) and blockchain are driving end-to-end traceability solutions, bridging the gap between different systems and allowing information to move seamlessly through them.

For example, real-time tracking performed by IoT-enabled, item-level sensors allows companies to detect potential damage or negative events such as theft. These devices monitor and send updates about a product’s condition (e.g., temperature, humidity, pressure, motion and location) while it is in transit. They alert you as soon as something has gone wrong and give you the power to take action to mitigate further damage.

This is just one example of how data from a fully implemented real-time, end-to-end traceability platform can yield returns almost immediately by eliminating blind spots, identifying bottlenecks and threats, and validating sourcing requirements. Such rich data can also change outcomes by, for example, empowering you to respond to alerts, intercept suspect products, extend shelf life, and drive continuous improvement.

As for AI technologies, they use data to learn and predict outcomes without human intervention. Global supply chains are packed with diverse types of data (e.g., from shippers and suppliers, information about regulatory requirements and outcomes, and public data); when combined with a company’s internal data, the results can be very powerful. AI is able to identify patterns through self-learning and natural language, and contextualize a single incident to determine if a larger threat can be anticipated or to make decisions that increase potential. For example, AI can help automate common supply chain processes such as demand forecasting, determine optimal delivery routes, or eliminate unforeseeable threats.

Blockchain has garnered a lot of buzz this year. As a decentralized and distributed data network, it’s a technology that might help with “unknowns” in your supply chain. For example, raw materials and products pass through multiple trading partners, including suppliers, manufacturers, distributors, carriers and retailers, before they reach consumers, so it can be difficult to truly know—and trust—every partner involved in your supply chain. The immutable nature of blockchain data can build trust and secure your operations.

To date, many F&B companies have been hesitant to start a blockchain initiative because of the capital risks, complexity and time-to-value cost. However, you don’t have to dive in head-first. You can start with small pilot programs, working with just a few stakeholders and clearly defining pilot processes. If you choose the right solution provider, you can develop the right cultural shift, defining governance and business models to meet future demands.

To summarize, new technologies are not disruptive to the F&B industry. If you work with an experienced solution provider, they will be constructive for the future. Ultimately, it’s worth the investment.

So how can the F&B industry start acting now?

How to Achieve End-to-End Traceability

Digitize Your Supply Chain. We live in a digital world. The modern supply chain is a digitized supply chain. To achieve end-to-end traceability, every stakeholder’s data must be digitized. It doesn’t matter how big your company is—a small operation or a global processor—if your data isn’t digitized, your supply chain will never reach peak performance.

If you haven’t begun transitioning to a digitalized supply chain, you should start now. Even though transforming processes can be a long journey, it’s worth the effort. You’ll have peace of mind knowing that your data is timely and accurate, and that you can utilize it to remain compliant with regulations, meet your customer’s demands, interact seamlessly with your trading partners, and be proactive about every aspect of your operations. And, of course, you’ll achieve true end-to-end supply chain traceability.

Standardize Your Data. As the needs of global F&B supply chains continue to expand and become more complex, the operations involved in managing relevant logistics also become more complicated. Companies are dealing with huge amounts of non-standardized data that must be standardized to yield transparency and security across all nodes of the supply chain.

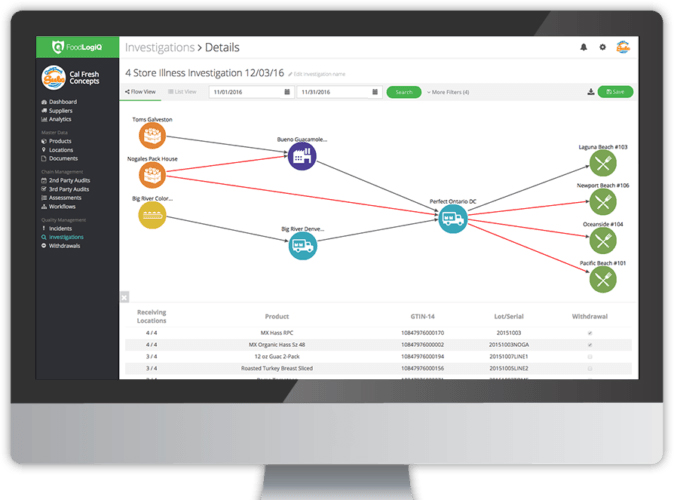

Many things can cause inconsistencies with data. Data are often siloed or limited. Internal teams have their own initiatives and unique data needs; without a holistic approach, data can be missing, incomplete or exist in different systems. For example, a quality team may use one software solution to customize quality inspections and manage and monitor remediation or investigations, while a food safety team may look to a vendor management platform and a supply chain or operations team may pull reports from an enterprise resource planning (ERP) system to try and drive continuous improvement. Such conflict between data sources is problematic—even more so when it’s in a paper-based system.

Insights into your supply chain are only as good as the data that have informed them. If data (e.g., critical tracking events) aren’t standardized and quality-assured, companies cannot achieve the level and quality of information they need. Data standards coming from actors such as GS1 US, an organization that standardizes frameworks for easy adoption within food supply chains, can help with this.

There are many solutions to ensure data are standardized and can be shared among different supply chain stakeholders. With recent increases in recalls and contamination issues in the United States, the need for this level of supply chain visibility and information is even more critical.

Data Security. Data security is crucial for a successful digital supply chain with end-to-end traceability, so you must plan accordingly—and strategically. You must ensure that your data is safe 24/7. You must be certain you share your data with only people/organizations who you know and trust. You must be protected against hacks and disruptions. Working with the right solution provider is the best way to achieve data security.

Incentive Structures. Incentives to digitize and standardize data are still lacking across some parts of the F&B supply chain, increasing the chances for problems because all stakeholders are not on the same page.

Companies that continue to regard adopting traceability as a cost, not an investment in operations and brand security, will most likely do the minimum from both fiscal and regulatory standpoints. This is a strategic mistake, because the benefits of traceability are almost immediate and will only get bigger as consumers continue to demand more transparency and accuracy. Indeed, we should recognize that consumers are the driving force behind these needs.

Being able to gather rich, actionable data is the key to the future. Industry leaders that recognize this and act decisively will gain a competitive advantage; those that wait will find themselves playing catch-up, and they may never regain the positions they’ve lost. We can’t overstate the value of high-quality digitized and standardized data and the end-to-end traceability it fuels. If companies want to achieve full visibility and maximize their access to information across all nodes of their supply chains, they must embrace the available technologies and modernize their data capabilities. By doing so, they will reap the benefits of a proactive and predictive approach to the F&B supply chain.