It’s no secret that the COVID-19 pandemic had a major impact on industries and individuals around the world. According to the World Health Organization, as of June 21, 2020, there have been 8,708,008 reported cases of COVID-19 globally, including 461,715 deaths. In a recent article by Forbes, healthcare contributor William Haseltine stated that we are gathering personal stories and statistics right now around COVID-19 survivors who have suffered permanent injuries from the virus. Many experts believe that COVID-19 is also an economic downturn trigger. Author and financial planner Liz Frazier says that even as recessions are a normal part of the U.S. economic cycle, lasting about five and a half years on average, the possibility of a recession starting due to the outbreak would be unprecedented.1 The COVID-19 pandemic is a natural disaster that rocked the world and is a reminder of how connected people are in a global economy.

As quarantine regulations and temporary closures happened across the United States, businesses had to mobilize quickly, pivoting their strategies, distribution efforts, products and beyond to accommodate the new safety measures and external pressures. The food and beverage industry was no different. Although food manufacturers were deemed essential in the United States by Cybersecurity & Infrastructure Security Agency (CISA), manufacturers had to adapt to a new normal during the shutdown.2 Some of the biggest changes that occurred in the food manufacturing industry include fluctuating customers, prices, product and ingredient availability, packaging, distribution, and food quality and safety.

Shifting Demand, Customers and Food Pricing

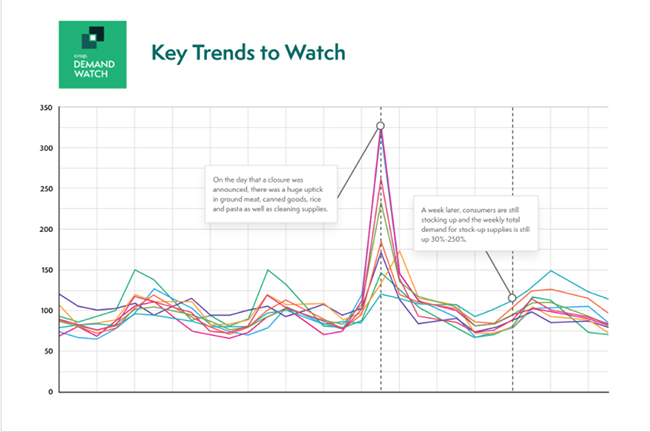

Sharp changes in food prices and product availability shocked supply and demand and impacted the entire food supply chain across the United States. According to the USDA, there were record levels of demand for food at grocery stores, and, on the supply side, there has been a reduced supply of meat products over the period of quarantine as meatpacking plants faced temporary closures, decreased slaughter pace, and slower production due to COVID-19 regulations.3 Poultry prices took a sharp dip and have been rebounding, hot dog prices are at an all-time high due to increased demand, and beef prices have been climbing due to scarce supply and limited fresh production. Food pricing fluctuation is one of the largest food industry impacts felt directly by the general public and the on-premise sector. Restaurants and bars were crushed by the skyrocketing ingredient prices and mandatory temporary closures due to COVID-19.

As restaurants, school cafeterias and hotels were temporarily shut down due to quarantine restrictions, the food manufacturing industry’s most prominent customers practically disappeared. Before COVID-19, the USDA reported that in 2018, restaurants provided approximately 50% of meals consumed on a daily basis, up from 41% in 1984.4 When COVID-19 hit, consumer trends showed a monumental shift to eating at home. During the height of the pandemic, more people ordered take out from fast-casual dining places and ate from home. A recently published study reveals survey findings that suggest American’s food habits are shifting, as 54% of respondents confirmed they are cooking more, and 46% of respondents, baking more.5 As customers and demand changed, products and packaging had to follow suit.

Scores of manufacturing facilities had to rapidly respond with different products to meet changing consumer demand, despite already being in mid-production for products for restaurant kitchens, cafeterias, and the like. Most of these large-scale and wholesale products would never make it to their original, intended destinations. Manufacturers swiftly adapted their production, creating retail-ready goods from product made or intended for restaurant or fast food supply. These food production facilities had to creatively find ways to change product packaging sizes, salvaging good product with take-home cartons and containers. Some processors pre-sliced deli meat for grocery stores around the country, as markets were unable to slice the meat in-store, dealing with restrictions on the number of people who could work at any given time. The food manufacturing industry showed great ingenuity, repurposing food and getting creative in order to keep the country fed and bridge the gap in convenience shopping that consumers have grown used to.

New Distribution Pressures

There were also disruptions in the food industry’s distribution channel, and the logistics of distribution were adversely affected. Facilities faced increased pressure to have tighter production turnarounds from new consumer behavior and out-of-stock situations as many markets dealt with temporary panic shopping at the beginning of the crisis. Food manufacturing facilities have always faced tight deadlines when dealing with fresh and refrigerated product. However, COVID-19 introduced new critical, immediate needs to the food supply, and, more than ever before, facilities were pressed for time to deliver. Some facilities didn’t have enough dock loading time, and certain cold storage facilities could not meet the raised demands for dock times, making it harder to get product through the distribution channel to consumers. Shipping and logistics came at a premium. Drivers and logistics companies were at capacity with their service offerings, and unable to mobilize to meet the needs of every manufacturing company.

On top of the pressures from consumer demand, manufacturing facilities had to procure PPE (personal protective equipment) in mass for all employees and adjust employee schedules to meet new national and state-wide quarantine restrictions that strained the system. The PPE requirements are part of the distribution logistics, as plants are unable to distribute safe product without adhering to the system’s regulations. Senior Vice President of Regulatory and Environmental Affairs for the National Milk Producers Federation, Clay Detlefsen, said in an article for Food Shot Global that the whole food industry’s system has been turned on its head, as manufacturers are concerned that if they start running out of PPE and sanitation supplies, they would ultimately be forced into shutting down their food processing plants.6

Regulating Food Quality and Safety

Perhaps one of the biggest concerns surrounding the food supply chain during the height of COVID-19 for both producers and consumers was food safety. While safety and quality are always a high priority in the food industry, rising concern around the transmission of COVID-19 became a new and unprecedented challenge for food quality experts. In February the FDA declared that COVID-19 is unlikely to pass through food or food packaging, but that didn’t stop public concern.7 It was critical for food manufacturers and producers to ease public fear, keep the food supply stable and eliminate foreign material contamination that would adversely affect consumers and brand reputation. A mass recall due to foreign material contamination would have dire consequences for the strained food supply chain during this historic crisis. At the same time, the pandemic limited quality and food safety teams, as key teams had to work remotely, shift schedules had to drastically change to meet new safety regulations, production lines cut in half, and quality and safety teams had to make rushed decisions when it came to reworking product.

Some plants that faced potential foreign material contamination risked sending their product into distribution without a thorough rework, up against tight deadlines. And some plants adopted a multifaceted strategy and did something they’ve never done before: Reworked product on hold for potential foreign material contamination themselves. Many of these companies reworked product with their extra available lines, to keep as many of their workers as possible, despite the fact that food production employees are untrained in finding and extracting foreign contaminants. Inline detection machines are also typically limited to metal detection, often incapable of consistently catching many other types of contaminants such as glass, stones, plastic, bone, rubber, gasket material, container defects, product clumps, wood and other possible missing components. Food safety is of the utmost importance when a crisis hits as the food supply chain is crucial to our success as a nation and as an interconnected world. Facing new pressures on all sides, the food industry did not neglect food safety and quality, even while adopting new strategies. There was never a doubt that the industry would overcome the new challenges.

Looking Forward

The food industry has rapidly switched business strategies, swiftly turned around new products, found new ways to align product traceability and work remotely while still meeting industry standards and production expectations. Manufacturing facilities repackaged and repurposed food to keep the country fed, maintained job security for many employees and procured PPE in mass. The food industry is also full of manufacturers and plants that accomplished things they’ve never done before. There are shining examples of heroism in the food and beverage space as a growing list of food businesses, restaurants and delivery services have donated to healthcare workers on the front lines. Many large companies donated millions of dollars and pounds of food to feed their teams, their communities and the less fortunate.8 In the midst of a large obstacle, we have reached new heights and discovered new capabilities.

The challenges aren’t over. The food industry is still facing the effects of COVID-19 shutdowns on businesses even during this period of re-opening in different parts of the country. A lot of places and companies have been hit hard, some even closing their doors for good. Forbes reported at the onset of the pandemic that Smithfield Foods shut down one of its pork processing plants after hundreds of the plant’s 3,700 employees tested positive for coronavirus.8 Tyson Foods also shut down several meat processing plants under threat of the virus.8 Smithfield and Tyson were not the only ones. Food Dive has a compiled tracking system for coronavirus closures in food and beverage manufacturing facilities, recording reduced production, temporary closures, and permanent shutdowns across the industry. We expect some of the COVID-19 challenges to alleviate over time and hope that business will slowly return to normal and previously closed facilities will be able to re-open. However, we strongly hope some changes to the industry will remain: Creativity, ingenuity, resilience, adaptability, and a strong commitment to customers and partners. The bottom line is we’re in this together––together, we’re resilient.

References

- Frazier, L. (April 21, 2020). “How COVID-19 Is Leading The US Into A New Type Of Recession, And What It Means For Our Future.” Forbes.

- Krebs, C. (May 19, 2020). “Advisory Memorandum on Identification of Essential Critical Infrastructure Workers During COVID-19 Response.” Homeland Security Digital Library.

- Johansson, R. (May 28, 2020) “Another Look at Availability and Prices of Food Amid the COVID-19 Pandemic.” USDA.

- Stewart, H. (September 2011). “Food Away From Home.” The Oxford Handbook of the Economics of Food Consumption and Policy. 646–666. Oxford University Press. doi: 10.1093/oxfordhb/9780199569441.013.0027

- The Shelby Report. (April 17, 2020). “New Study Reveals Covid-19 Impact On Americans’ Food Habits.”

- Caldwell, J. (April 16, 2020). “How Covid-19 is impacting various points in the US food & ag supply chain”. AgFunderNews.

- Hahn, M.D., S. (March 27, 2020). Coronavirus (COVID-19) Supply Chain Update. FDA.

- Biscotti, L. (April 17, 2020). “Food And Beverage Companies Evolve, Innovate And Contribute Amid COVID-19 Crisis.” Forbes.