In the age of AI and automation, we are all focused on efficiency. When saving time and resources is the name of the game, as professionals, we must regularly assess new methods and processes, looking for solutions that make our labs run more effectively.

Across the food safety testing industry, we continuously look for ways to improve our laboratory spaces and teams. How can we test more quickly? How can we work more effectively as a team? How can we build resiliency within our labs and throughout the industry?

When we look at the history of our industry, we see the traditional, tried-and-true reference methods as the gold standard—we know that they work, and they are widely trusted and accepted. However, when we look at these methods in a modern context, we notice several areas in which they could be improved.

These traditional methods are often slow to produce results and highly labor intensive. When compounded by the ever-present issue of staff hiring and retention, it becomes increasingly apparent that labs need to streamline and simplify testing methods.

The fact is that the modern lab is no longer only a space for traditional testing methods but a hub for innovative, cutting-edge technologies.

In a time when consistency, speed, and accuracy are paramount, it’s important we, as food safety professionals, look for methods, equipment, and processes that are easy to use, easy to replicate, and easy to interpret.

So, what does a modern lab involve?

When thinking of building a modern lab, the need is to address three key issues:

- How can we speed up our decision-making? Using rapid, easy-to-use technologies allows labs to receive feedback on environmental testing and harmonize result interpretation quickly. Advanced technologies with ready-to-use and straightforward assays and automated procedures also speed up processes and allow faster, more reliable processing speeds and confident decision-making.

- How can we demonstrate our ability to comply with food safety standards?The answer is simple: digitalization, proactivity, and traceability. By utilizing enhanced data management and integration systems, labs can manage a high volume of data, turning it into actionable insights. That data is then, used to demonstrate compliance across a variety of standards and specifications.

- How can we feel confident in our results?Implementing new, more modern technology can be intimidating, and given the pressure that high turnover rates place on labs, we must trust the results we share. Automation, standardization in result interpretation, and enhanced data management can help lab managers and decision-makers make the best decisions for the enterprise, knowing that each laboratory analyst is measuring the same metrics, no matter their tenure. Implementing modern solutions makes standardizing testing methods and result interpretation easy, so you can feel comfortable and confident in your data.

Another critical aspect of building a modern lab is networking with our peers across the food safety industry. Attend conferences and webinars, read articles, ask questions, and find out what modern solutions are working for other labs in the industry. Recognizing the value that we get from listening and learning from other experts helps our industry grow.

As the food safety testing industry moves into a more modern era of operations, we must remember that change is good. Change moves us forward, enhances efficiency, and increases confidence while creating sustainable and reliable systems and processes.

Creating modern labs within our various entities around the world will take the food safety testing industry to a new frontier as we all work toward the same goal — keeping people around the world safe and healthy.

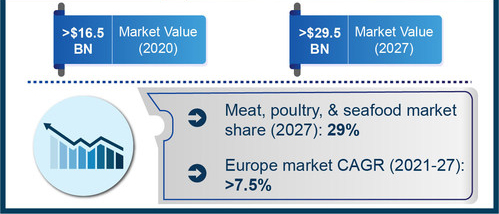

These factors are contributing to the growth of the global food safety testing market, driven by the worldwide increase in outbreaks of foodborne illness and implementation of stringent food safety regulations.

These factors are contributing to the growth of the global food safety testing market, driven by the worldwide increase in outbreaks of foodborne illness and implementation of stringent food safety regulations. The SaniTimer® automatically begins a 30-second countdown — the extra 10 seconds account for an individual’s preferred hand-wash prep — shown on an easy-to-read LED display as soon as the water is turned on. At the end of the cycle, the SaniTimer beeps to alert the hand washing user and resets itself to 30 seconds for the next member. The device works with pedal sinks as well as hands-free sinks for ease of installment and operation with your existing system.

The SaniTimer® automatically begins a 30-second countdown — the extra 10 seconds account for an individual’s preferred hand-wash prep — shown on an easy-to-read LED display as soon as the water is turned on. At the end of the cycle, the SaniTimer beeps to alert the hand washing user and resets itself to 30 seconds for the next member. The device works with pedal sinks as well as hands-free sinks for ease of installment and operation with your existing system.