Tag Archives: ingredients

Not A Boring Vanilla Kind Of Life

Vanilla is one of the most popular and expensive flavoring ingredients, used in ice cream, dairy, beverages, baked goods and more. Its smooth, warm taste and ability to enhance other flavors make it a sought-after element in cooking and baking worldwide. Insufficient natural sources, impacted by adversary weather events, are unable to keep up with an increasing demand. As a result, what is labeled as “pure vanilla” is occasionally adulterated with ingredients that are not derived from vanilla beans, but either synthetic or made from other plant or even animal sources. In the case of on Australian retail company, the vanilla extract was mislabeled as “pure” with a picture of vanilla plant parts shown on the label, misleading consumers. The Australian Competition and Consumer Commission issued a hefty fine after two infringement notices.

Resource

- ACCC Media Team. (December 23, 2021). “HBC Trading pays penalties for allegedly misleading Chef’s Choice alcohol free ‘pure’ vanilla extract claims”. Australian Competition & Consumer Commission.

Clearing the Beer Haze with Advanced Turbidity Testing Technologies

Beer is one of the world’s oldest beverages, with evidence suggesting production as far back as the Bronze age. While beer is no longer used as renumeration for work as it was in the Mesopotamian Fertile Crescent, it is nevertheless a common pleasure for many people. Craft brewing is a relatively new phenomenon, and quite different from the brewing processes of antiquity. In the United States, immigrants from Germany and Czechia began to experiment with new recipes for craft beer in the 1960s. These recipes, often based on the Bavarian 16th century Reinheitsgebot, or purity laws, ensured that only the purest, highest quality ingredients went in to make beer: Water, barley, hops and yeast.

Since then, there has been a rapid growth in the number of microbreweries that experiment with “new-world” hops and grains to create huge ranges of flavorful beers that go far beyond traditional recipes. This variety in brewing ingredients and approaches has, in part, supported the explosion of a mass market for craft beer. In 2020, the global market value of craft beer was estimated at nearly $165 billion, and is expected to grow to nearly $554 Billion by 2027, with the largest growing markets in countries like China, Japan and the United States. There has also been a shift in which types of beers are consumed, with more premium or specialized craft beers increasing in market share with respect to low-cost mass-production beers.

In such a crowded and dynamic market, beer producers are faced with competitive challenges like never before. Ensuring a consistently high-quality product with a distinctive flavor profile that can be enjoyed time and time again is critical for market success. One of the key challenges standing in the way of achieving this is turbidity, or “haze”, in the end product. Such haze can give an unsightly first impression to consumers, compromise flavor, and negatively impacts shelf stability. In this article we discuss how new, advanced turbidity testing technologies are enabling brewers to quickly and efficiently eliminate haze from their beers, supporting breweries in their goals of delivering great consumer experiences again and again.

Quality over Quantity

With the growing “premiumization” of beers, ever-greater attention and importance is being placed on interesting and consistent flavor profiles. Often, this includes beers made from ingredients far outside the relatively strict Reinheitsgebot recipe, including additions such as coffee, fruit and spices. The emphasis on more complex flavor profiles is pushing beer tasting to be taken as seriously as wine tasting, with perfectly balanced beers often being designed to match certain foods.

However, the addition of these newer ingredients can introduce challenges into the brewing process, especially as they can be sources of turbidity-causing impurities that may affect the quality, flavor and shelf stability of the final product. This is particularly challenging when beer brewing is scaled up to larger manufacturing quotas, where careful control of variables like ingredient choices, recipes and manufacturing methods are critical for ensuring the consistency and quality of the beer from batch to batch.

To meet these needs, modern breweries are increasingly using new and advanced technologies throughout the brewing process to maintain high quality products. Technologies like water purification systems, titrators and portable instruments such as hand-held pH meters and spectrophotometers are all being utilized to improve and refine the manufacturing process. A major focus of this technological drive is in turbidity detection and removal.

What Is Haze, and Where Does It Come From?

Haze is a broad term referring to evenly distributed turbidity—suspended, insoluble material which can appear in the final product. Haze can be divided into several types, most commonly: Chill haze, a temporary haze that disappears when a chilled beer warms to room temperature; and permanent haze, which is present at all temperatures. Haze can also be divided into biological haze (caused by microbiological growth in the beer) and non-biological haze (caused by a wide variety of non-living material, such as peptides, polyphenols and starches).

Since turbidity can be the result of unwanted microbes, wild yeast or protein particles, these deposits, although not unsafe to consume, can significantly alter the flavor profile of the beer, adding unpleasant acidity, sourness, or even “off” flavors. Bacteria are one of the major sources of turbidity in beers, particularly lactic acid-producing bacteria (LAB), such as Lactobacillus. While small amounts of lactic acid can add pleasant, desirable sour flavors in sour beers, the over-presence of these bacteria can be a major cause of contamination, so their levels must be closely monitored in the brewing process. Other bacteria like Pectinatus species can also “infect” beers, causing turbidity as well as “off” aromas and flavors due to the creation of hydrogen sulfide and fatty acids.

Importantly, turbidity-causing compounds can collect in the product from all stages of the brewing process:

- This starts with the source of water, and how it is filtered and treated. For example, a high presence of calcium in brewing water can cause precipitation of calcium oxalate.

- Mashing, the first stage of the brewing process, produces a malt extract from mixing grains and water. The malt extract is a liquid containing sugar extracted during mashes and has high viscosity and high protein content. At this stage fungi (like Penecillium), wild yeasts (Candida) and bacteria can all enter the mix to cause turbidity later on.

- From there, the process of lautering separates the wort from the grain. The wort is then boiled with hops, clarified, then fermented with yeast. The fermentation process is a common step when turbidity-causing bacteria like Lactobacillus and Pediococcus can contaminate the mixture.

- The fermented beer product is then stored for anything from three weeks to three months in a storage tank where a second fermentation takes place. Then it is filtered and packaged into barrels, bottles, or cans; all of which are also potential sources of turbidity-causing bacteria like Pectinatus.

The filtration and pasteurization processes are key for removing sources of turbidity. However, these processes do not necessarily remove all sources of turbidity, especially if aspects of the brewing process are altered by external factors (e.g., subtle shifts in the mashing temperatures) and cause a buildup of contaminants that is too great to filter out. Therefore, effectively monitoring and minimizing turbidity throughout the brewing process is critical, allowing brewers to make timely corrective adjustments, reducing a buildup of contaminants in the final product.

Advanced Methods for Turbidity Testing

To support effective haze removal and ensure beer consistency, turbidity measurements must be taken throughout the entire brewing process. Measurements should therefore be quick and efficient, and able to measure large quantities of beer in a short space of time, especially in high-production breweries. As such, advanced on-site turbidity testing technologies that are efficient and easy to use are ideal, and can rapidly streamline quality control in the brewing process. For example, with turbidity meters, breweries can swiftly check that their fining or filtration process is yielding a desired end product, and if an issue arises during the clarification process, an onsite turbidity measurement can pick this up right away for speedy corrective action. Such speedy rectification minimizes the chances of ruined batches and resultant profit loss to the brewery.

Modern turbidity meters work by using an infrared LED light source to measure light scattering in a solution. These handy devices allow brewers to perform rapid testing of beer with simple grab samples, meaning samples can be analyzed without having to disturb the brewing process. The LED light sources used in more advanced meters also have several benefits. For example, the LED does not require a warm-up period like older tungsten lamps, meaning it is ready to use at all times. Secondly, infrared LED light sources prevent color interference, which is especially useful for testing darker beers. Finally, the LED will last the life of the meter and give stable signals, meaning that calibration does not drift. Turbidity meters can also test for chill haze, allowing brewers to check for problems that can cause the beer to turn cloudy during prolonged chilling.

Quality Kings

Quality control of the brewing process is crucial for maintaining the quality and consistency of beer products that keep customers returning time and time again to their beers of choice. In a hyper-competitive market, brewers must use all the advantages they can to stay ahead of the game. Hazy beers can be particularly off-putting to customers if they are expecting bright, clear products, and critical qualities like taste and aroma can be very unpleasant if contamination isn’t carefully controlled. Moreover, unwanted turbidity in beers can negatively impact shelf stability, with resultant impact on profitability and brand reputation.

Owing to the complexity of beer making, the sources of turbidity are multiple, meaning that careful testing of turbidity is critical. In helping to overcome these challenges, advanced turbidity meters are enabling brewers to perform efficient and simple measurements on-site throughout the brewing process. This is helping to drive more timely tweaks to the brewing, filtration and storage steps to ensure consistent, high-quality beers with carefully crafted flavor profiles reach the market.

Yellow Is Not Always Golden

Organized crime in Spain laundered millions of euros by selling saffron adulterated with dyes and herbs, some of these adulterants being unfit for human consumption. Spanish police with the assistance of Europol busted an importer who adulterated imported saffron threads and sold them with the high-end La Mancha region designation. The supply chain for the organized crime scheme was operating across the EU, with 17 arrests made in the sting operation.

Resource

1. Interpol and Europol. (April 12, 2020). “Adulterated saffron scam busted in Spain”. Securing Industry.

California Proposition 65: Every Company Should Know Their Risk

Known officially as The California Safe Drinking Water and Toxic Enforcement Act of 1986, California Proposition 65 reaches far beyond state boundaries and has potential regulatory implications for almost any company that manufactures, imports, and / or sells products containing listed chemicals in the state. California Prop 65 prohibits the sale of a product in California that knowingly and intentionally exposes an individual to a California Office of Environmental Health Hazard Assessment (OEHHA) listed chemical without a specific stated warning. For many food and supplement companies, the risk of opportunistic litigation based on California Prop 65 drives the need to monitor updates, new amendments and enforcement of the law.

Prop 65 Background

California Proposition 65, also known by the shortened name Prop 65, is not a ban on products or ingredients. The law is intended to inform consumers in California about exposure to a list of chemicals exceeding a defined level in products for sale, including product packaging. The regulation mandates a warning label for exposure to chemicals at a level that could cause cancer, birth defects or other reproductive harm. Guidance for upper limits (“Safe Harbor Level”) on chemicals is based on expected daily exposure. If no Safe Harbor Level exists for a chemical, the product containing a listed chemical must include a warning, unless the exposure level can be proven to not pose a significant risk of causing harm.

With the size of the California economy and the interconnected U.S. supply chain, the state law effectively reaches other states and U.S. importers. More recently, the Prop 65 requirements impact online and catalog sales, which have increased significantly during the global pandemic.

Know Your Suppliers

All companies need to proactively evaluate and document Prop 65 risks. Enforcement occurs primarily through civil litigation, resulting in specialized legal firms profiting from a company’s ignorance of the law’s extent. Even the threat of publicity from a lawsuit can cause targeted companies to settle a case.

At each point of manufacturing and distribution—supplier, manufacturer, packager, importer or distributor—regulatory teams should ask about Prop 65 compliance. The main point of responsibility is at the manufacturer, but a retailer can also be obligated for introducing a chemical at point-of-sale.

What’s New with Prop 65

The OEHHA issues notices regarding amendments to the California Code of Regulations Title 27, Article 6, covering “Clear and Reasonable Warnings”. Recently the OEHHA requested public comments on proposed amendments that would modify the content and methods for providing “short-form” warnings. The short form was originally intended for products with restricted label space.

The proposed rule would modify the existing short-form warning provisions to:

- Only allow use of the short-form warning on products with five square inches or less of label space.

- Eliminate use of short-form warnings for products sold via the Internet and catalogs.

- Clarify how short-form warnings can be used for food products.

- Require the name of at least one chemical be included in the short-form warning.

Bottomline: Know Your Business and Risk

As an advisor with more than 20 years of regulatory compliance experience in food and food ingredients, my guidance for business best practice on Prop 65 is to be proactive, maintain supply chain knowledge, and understand risk. Regulatory or legal staff, or consultant teams specializing in Prop 65, should regularly monitor for additions to the chemical list and rulemaking changes to the far-reaching law.

The Drive to Sustainable Food Manufacturing Begins with Three Critical Factors

Sustainability, without question, is one of the hottest social and political topics today. It is as complex as it is simple. Sustainability gets discussed in almost every walk of life, but in the world of food manufacturing, there are few subjects more debated than this one. It is a contentious subject because in the manufacturing arena, it is not just a social or political issue, it is a financial issue—a big financial issue. Sustainability and related issues around it are critical factors and components that are now impacting the bottom lines of food manufacturers. The impact is seen in terms of both red and black.

In a low-margin business like food manufacturing, profits are at a premium and even a minor disruption can negatively impact those profits. Adapting to all the issues that are involved in and around sustainability is, without question, a disruption for manufacturers. At the same time, manufacturers can make positive impacts through smart operational decision-making, which is where sustainability has the greatest presence. When sustainability is discussed in regards to food and beverage manufacturing, a number of topics surface. Some topics are discussed individually and some are grouped together. Consumer preferences, new foods, and packaging are three such areas. At first glance, you might ask why they are lumped together. They are lumped together because they are actually very closely related. Let’s explore those connections especially as they relate to finances.

Consumer Preferences: Paving the Sustainable Path

Consumer preferences have always been one of the leading factors determining what food and beverage manufacturers produce and send to market. For generations, countless amounts of time and money have been spent on trying to predict what consumers want and when they want it. A tremendous amount of data is painstakingly analyzed by manufacturers trying to figure out the consumer’s next move.

According to a 2018 Global Web Index survey, half of digital consumers say environmental concerns influence their purchasing decisions. Millennials—sometimes named the Green Generation—and Generation Z lead the way. About 61% of millennials and 58% of Gen Z’ers say they would pay more for eco-friendly products. Green consumers want brands to embrace purpose and sustainability, and they want their purchases to contribute to the greater good, or at least, do no harm.

These preferences started among millennials and Gen Z’ers, but with the influence of social media, they have expanded to all age groups. This expansion has contributed greatly to a change in what consumers purchase and to what manufacturers produce. In recent years, consumers have changed their eating habits in terms of what they eat, how they eat and when they eat, and those changes have impacted both food service and retail food producers. They have largely centered on healthier foods, pure ingredients and products that promote an eco-friendly culture and a sustainable world. The changes have been felt up and down manufacturing organizations, but most importantly they are reflected in the bottom line.

The industry has been forced to introduce healthier products, with more ethically sourced ingredients and more transparent supply chains. Younger consumers, especially, often trace a brand’s sustainability record with QR codes or smart labels. They want to know where their food originates. They don’t just want to know in which state the potato used in their organic baked potato crisp was grown. They want to know the county, town, farm, field and names of the people who picked it so they can connect with them on Facebook to determine if they practice safe hygiene principles! If a product doesn’t fit the consumers’ predetermined sustainable criteria, they buy a product from another manufacturer. Talk about an impact to profits. The consumer focus on sustainability has increased competition and costs, forced organizational changes and made food manufacturers figure out what processes and systems need to be in place to ensure their decisions keep consumers happy and their profits on the right side of the ledger. These consumer actions and attitudes are now influencing the development of new food items as manufacturers realize consumers are not just taking notice but taking actions as well.

New Foods: Where’s the Beef? Not Here!

As consumers change their food preferences for health and sustainability reasons, food and beverage producers have the opportunity, responsibility and if they want to survive, the mandate to develop new food products built on a reputation for sustainability. Brands have been working on protein alternatives for some time, but not until Burger King and McDonald’s introduced plant-based burgers did plant-based protein go “viral” so to speak. Talk about “Where’s the beef?” In addition to meeting the needs of the drive for sustainable foods, food manufacturers are developing plant-based proteins and many new foods to support the healthier lifestyle movement. As consumers embrace Keto diets, veganism, vegetarianism and other new eating and living practices, tofu, soybeans, seeds, nuts, legumes and other vegetable-based products are now being routinely used as replacements for protein, carbohydrate-heavy flours and food foundation bases.

Ten years ago, if I said in 2021 we would be eating pizza with a crust made of cauliflower, what would the public reaction have been? People in Chicago would have thrown away their deep-dish pans. Food manufacturers now introduce new products on a weekly basis and it is having a tremendous impact on sales and bottom lines. These rapid introductions also impact other key areas of the organization including supply chain, product development cycle and manufacturing cost infrastructure.

Substituting vegetables for carbohydrate-rich grains, of course, costs money. It can increase material costs, manufacturing costs, warehousing costs and distribution costs, which combine to raise retail prices. Luckily, as we have illustrated, consumers are willing to pay more for products that they perceive as having a sustainable footprint. Utilizing products differently to respond to the push for sustainability is a smart tactic that can expand the value chain, open up new markets and drive sales for food and beverage manufacturers.

Packaging Sells Products and Sustainability

Sustainable packaging can mean many things. It can mean packaging made with 100% recycled or raw materials, packaging with a minimized carbon footprint due to a streamlined production process or supply chain, or packaging that is recycled or reused. There is also biodegradable packaging like containers made from cornstarch being used for takeout meals.

For generations, packaging has had a tremendous influence on what consumers buy. Human beings are visual creatures. They are drawn to things that have visual and physical characteristics that appeal to the senses. How many products in the marketplace are known for a certain shape or color configuration? Many times, these shapes or colors can only be created using certain glass, plastic or other materials that might not meet the sustainable criteria. This has caused problems for manufacturers as consumers still want those products but are conflicted if their sustainable beliefs are compromised. Adapting new eco-friendly materials while retaining generations of packaging history and nostalgia can increase costs. But, to keep their customers, manufacturers make these changes, absorb the extra costs and try to make up for lost profits in other ways.

Packaging, especially smart packaging, can also help fight the battle against food waste. Packaging companies are creating and producing intelligent packaging for food products that have built-in sensors and monitors to determine when a product will lose its nutritional value or spoil. Smart labels are being used in conjunction with new packaging materials to monitor external factors that can influence product freshness. Packaging can be a driving force to reaching the goal of sustainability.

Adapting to changing consumer preferences, demand for new foods and new packaging materials and designs is critical for manufacturers trying to reach sustainable goals. Consumer preferences drive what manufacturers produce. Consumer preferences drive the development of new foods that consumers think they need in order to live a healthier lifestyle. Packaging is the wrapper that keeps the new foods fresh and catches the consumer’s eye, which in turn drives sales and thus drives profits. These three critical areas can be the foundation of the sustainable movement and manufacturing’s response to it. Food producers must embrace the sustainable movement if they want to stay in business. To meet this challenge, manufacturers of packaging and food need to evaluate their processes and systems and implement the ones that can help them cost-effectively transition to becoming sustainable manufacturers.

House Subcommittee Releases Report on Dangerous Levels of Toxic Heavy Metals in Baby Food

Last week a report released by Congress cited dangerous levels of toxic heavy metals in several brands of baby food. Back in November 2019, the Subcommittee on Economic and Consumer Policy asked for internal documents and test results from baby food manufacturers Nurture, Inc. (Happy Family Organics), Beech-Nut Nutrition Company, Hain Celestial Group, Inc., Gerber, Campbell Soup Company, Walmart, Inc., and Sprout Foods. According to the staff report, Nurture, Beech-Nut, Hain and Gerber responded to the requests, while Walmart, Campbell and Sprout Organic Foods did not.

The findings indicate that significant levels of arsenic, lead, cadmium and mercury were found in the baby foods of the four manufacturers who responded to the Subcommittee’s requests (Nurture, Beech-Nut, Hain and Gerber). It also stated the alarming point that, “Internal company standards permit dangerously high levels of toxic heavy metals, and documents revealed that the manufacturers have often sold foods that exceeded those levels.”

The Subcommittee voiced “grave concerns” that the baby food made by Walmart, Sprout Organic Foods and Campbell was “obscuring the presence of even higher levels of toxic heavy metals in their baby food products than their competitors’ products” due to their lack of cooperation.

In addition, the report states that the Trump administration “ignored a secret industry presentation to federal regulators revealing increased risks of toxic heavy metals in baby foods” in August 2019.

“To this day, baby foods containing toxic heavy metals bear no label or warning to parents. Manufacturers are free to test only ingredients, or, for the vast majority of baby foods, to conduct no testing at all,” the report stated (infant rice cereal is the only baby food held to a stringent standard regarding the presence of inorganic arsenic).

As a result of the findings, the Subcommittee has made several recommendations:

- FDA should require baby food manufacturers to test their finished products for toxic heavy metals.

- FDA should require manufacturers to report toxic heavy metals on food labels.

- Manufacturers should find substitutes for ingredients that are high in toxic heavy metals or phase out the ingredients that are high in toxic heavy metals.

- FDA should set maximum levels of toxic heavy metals allowed in baby foods.

- Parents should avoid baby foods that contain ingredients that test high in toxic heavy metals.

The 59-page report, “Baby Foods Are Tainted with Dangerous Levels of Arsenic, Lead, Cadmium, and Mercury”, is available on the U.S. House of Representatives’ website.

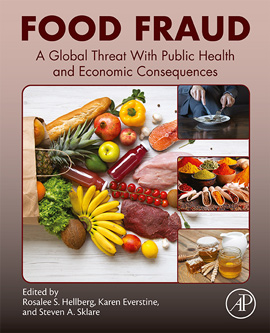

Fundamentals of Food Fraud Explained, Global Threat Cannot Be Ignored

Food fraud is a global problem, the size of which cannot be fully quantified. A new book edited and authored by experts on the topic seeks to comprehensively address food fraud, covering everything from its history and mitigation strategies, to tools and analytical detection methods, to diving into fraud in specific products such as ingredients, meat, poultry and seafood.

“As we point out in the first sentence of the introduction to Food Fraud: A Global Threat with Public Health and Economic Consequences, food fraud prevention and risk mitigation has become a fast-evolving area. So fast, in fact, that some people may question the value of publishing a comprehensive resource focused on these issues for fear that it will be outdated before the ink is dry. The co-editors of the book disagree,” says Steve Sklare, president of The Food Safety Academy, chair of the Food Safety Tech Advisory Board and co-editor of the book. “This book was written with the goal of providing a solid resource that is more than an academic exercise or reference. The discussion of the fundamental principles of food fraud mitigation and real-world application of this knowledge will provide a useful base of knowledge from which new information and new technology can be integrated.”

Sklare co-edited the book with Rosalee Hellberg, Ph.D., associate director of the food science program at Chapman University and Karen Everstine, Ph.D., senior manager of scientific affairs at Decernis and member of the Food Safety Tech Advisory Board. He hopes that offering access to the book’s first chapter will help communicate their message to the folks responsible for addressing food fraud, whether they are members of the food industry, regulators or academics, or professionals at small, medium or large food organizations.

Complimentary access to Chapter 1 of Food Fraud: A Global Threat with Public Health and Economic Consequences is available in the Food Safety Tech Resource Library. The preview also includes the book’s Table of Contents.

The Golden Goose, A Timeless Moneymaker

Grimm’s Fairy Tale got it right after all: The “Golden Donkey” (German expression for “Golden Goose”) does indeed exist. In India, officials shut down a factory producing fake turmeric, chili powder and other spices and condiments. Authorities confiscated mostly inedible and hazardous ingredients, which included man-made pigments and colorants, acids, hay and last but not least, donkey dung. The health impact and where the “spices” were sold in retail are under investigation.

Resource

- Mishra, S. (December 16, 2020). “Police raid factory making counterfeit spices ‘out of donkey dung and acid’”. Independent.

Food Authenticity: 2020 in Review

It is fair to say that 2020 was a challenging year with wide-ranging effects, including significant effects on our ongoing efforts to ensure food integrity and prevent fraud in the food system. COVID-19 caused major supply chain disruptions for foods and many other consumer products. It also highlighted challenges in effective tracking and standardization of food fraud-related data.

Let’s take a look at some of the notable food fraud occurrences in 2020:

- Organic Products. The Spanish Guardia Civil investigated an organized crime group that sold pistachios with pesticide residues that were fraudulently labeled as organic, reportedly yielding €6 million in profit. USDA reported fraudulent organic certificates for products including winter squash, leafy greens, collagen peptides powder, blackberries, and avocados. Counterfeit wines with fraudulent DOG, PGI, and organic labels were discovered in Italy.

- Herbs and Spices. Quite a few reports came out of India and Pakistan about adulteration and fraud in the local spice market. One of the most egregious involved the use of animal dung along with various other substances in the production of fraudulent chili powder, coriander powder, turmeric powder, and garam masala spice mix. Greece issued a notification for a turmeric recall following the detection of lead, chromium, and mercury in a sample of the product. Belgium recalled chili pepper for containing an “unauthorized coloring agent.” Reports of research conducted at Queen’s University Belfast also indicated that 25% of sage samples purchased from e-commerce or independent channels in the U.K. were adulterated with other leafy material.

- Dairy Products. India and Pakistan have also reported quite a few incidents of fraud in local markets involving dairy products. These have included reports of counterfeit ghee and fraudulent ghee manufactured with animal fats as well as milk adulterated with a variety of fraudulent substances. The Czech Republic issued a report about Edam cheese that contained vegetable fat instead of milk fat.

- Honey. Greece issued multiple alerts for honey containing sugar syrups and, in one case, caramel colors. Turkey reported a surveillance test that identified foreign sugars in honeycomb.

- Meat and Fish. This European report concluded that the vulnerability to fraud in animal production networks was particularly high during to the COVID-19 pandemic due to the “most widely spread effects in terms of production, logistics, and demand.” Thousands of pounds of seafood were destroyed in Cambodia because they contained a gelatin-like substance. Fraudulent USDA marks of inspection were discovered on chicken imported to the United States from China. Soy protein far exceeding levels that could be expected from cross contamination were identified in sausage in the Czech Republic. In Colombia, a supplier of food for school children was accused of selling donkey and horse meat as beef. Decades of fraud involving halal beef was recently reported in in Malaysia.

- Alcoholic Beverages. To date, our system has captured more than 30 separate incidents of fraud involving wine or other alcoholic beverages in 2020. Many of these involved illegally produced products, some of which contained toxic substances such as methanol. There were also multiple reports of counterfeit wines and whisky. Wines were also adulterated with sugar, flavors, colors and water.

We have currently captured about 70% of the number of incidents for 2020 as compared to 2019, although there are always lags in reporting and data capture, so we expect that number to rise over the coming weeks. These numbers do not appear to bear out predictions about the higher risk of food fraud cited by many groups resulting from the effects of COVID-19. This is likely due in part to reduced surveillance and reporting due to the effects of COVID lockdowns on regulatory and auditing programs. However, as noted in a recent article, we should take seriously food fraud reports that occur against this “backdrop of reduced regulatory oversight during the COVID-19 pandemic.” If public reports are just the tip of the iceburg, 2020 numbers that are close to those reported in 2019 may indeed indicate that the iceburg is actually larger.

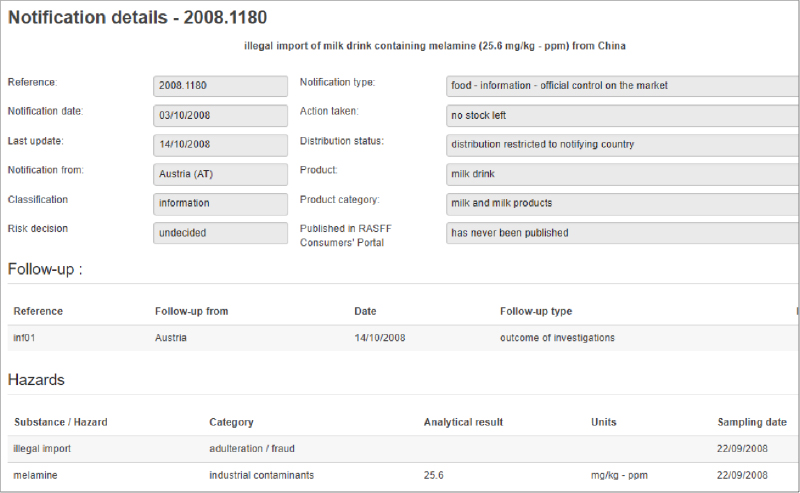

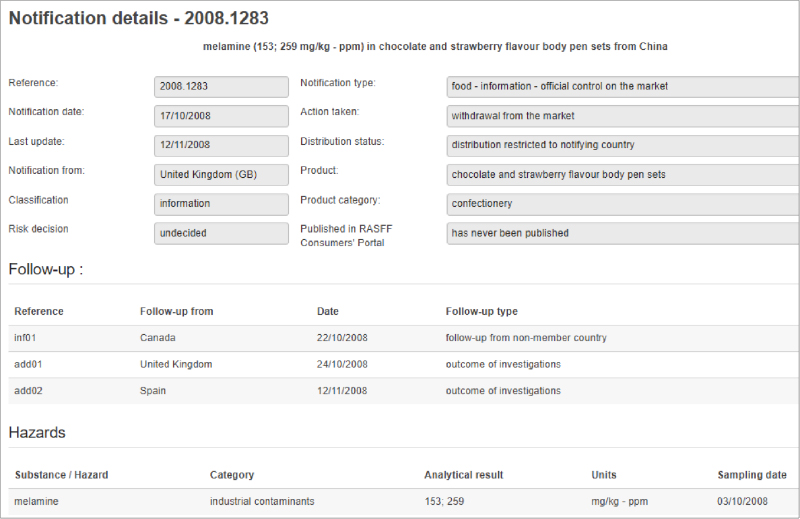

Unfortunately, tracking food fraud reports and inferring trends is a difficult task. There is currently no globally standardized system for collection and reporting information on food fraud occurrences, or even standardized definitions for food fraud and the ways in which it happens. Media reports of fraud are challenging to verify and there can be many media reports related to one individual incident, which complicates tracking (especially by automated systems). Reports from official sources are not without their own challenges. Government agencies have varying priorities for their surveillance and testing programs, and these priorities have a direct effect on the data that is reported. Therefore, increases in reports for a particular commodity do not necessarily indicate a trend, they may just reflect an ongoing regulatory priority a particular country. Official sources are also not standardized with respect to how they report food safety or fraud incidents. Two RASFF notifications in 2008 following the discovery of melamine adulteration in milk illustrate this point (see Figure 1). In the first notification for a “milk drink” product, the hazard category was listed as “adulteration/fraud.” However, in the second notification for “chocolate and strawberry flavor body pen sets,” the hazard category was listed as “industrial contaminants,” even though the analytical result was higher.1

What does all of this mean for ensuring food authenticity into 2021? We need to continue efforts to align terminology, track food fraud risk data, and ensure transparency and evaluation of the data that is reported. Alignment and standardization of food fraud reporting would go a long way to improving our understanding of how much food fraud occurs and where. Renewed efforts by global authorities to strengthen food authenticity protections are important. Finally, consumers and industry must continue to demand and ensure authenticity in our food supply. While most food fraud may not have immediate health consequences for consumers, reduced controls can lead to systemic problems and have devastating effects.

Reference

- Everstine, K., Popping, B., and Gendel, S.M. (2021). Food fraud mitigation: strategic approaches and tools. In R.S. Hellberg, K. Everstine, & S. Sklare (Eds.) Food Fraud – A Global Threat With Public Health and Economic Consequences (pp. 23-44). Elsevier. doi: 10.1016/B978-0-12-817242-1.00015-4