Since the early 20th century, food safety has been a paramount concern for consumers in the United States. Upton Sinclair’s The Jungle, which painted a bleak, brutal, and downright disgusting picture of turn-of-the-century food processing facilities led to the creation of some of the country’s first food safety laws. Today, federal agencies and statutes make up a comprehensive food safety system to ensure that the growth, distribution and consumption of foods are safe from start to finish.

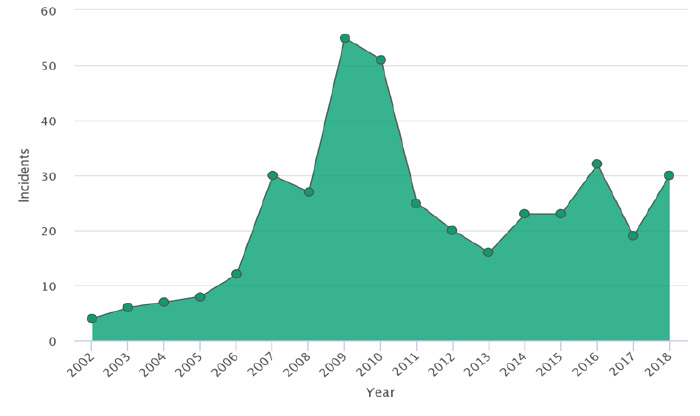

While food safety has significantly improved in the century since Sinclair’s time, stories of major outbreaks of foodborne illnesses continue to pop up across the country. Over the past few years, a significant number of outbreaks as a result of pathogens have made the headlines. To mitigate the threat of public health crises and ensure food production and distribution is safe and secure, companies must rely on modern technology to trace the movement of food across the entire supply chain.

How Technology Is Changing the Food Industry

Technology is a powerful, innovative force that has changed the way even well established companies must do business in order to stay relevant. From easier access to nutritional information to digital solutions that make food manufacturing and distribution more efficient, greater consumer awareness driven by technology empowers consumers to make decisions that can greatly affect the food industry’s bottom line.

Technology-driven accountability is playing one outsized role in allowing consumers to make better choices about the foods they consume and purchase. Social media and smartphone apps connect consumers to a wealth of resources concerning the harmful effects of certain ingredients in their food, the source of products, and how particular items are made and produced. In 2015, for example, The Campbell Soup Company removed 13 ingredients from its traditional soup recipes as a result of a greater public demand to understand food sources. Neither food giants nor small producers should expect to remain immune from greater public scrutiny over food health and safety.

Nutritional research is also helping change the conversation around food, granting nutritionists and consumers alike greater access to food-related data. Through easily accessible scholarly journals, apps that provide real-time nutrition information, and meal tracking apps that help users log and understand what they’re eating, consumers can gain a better understanding of nutrition to make more informed choices about their daily food intake. Researchers can also use food-tracking apps to make discoveries about consumer behavior and foods that are eaten.

Technology is also being used to tackle food waste, one of the most pervasive problems facing the food industry. One-third of the total amount of food produced globally, amounting to nearly $1.2 trillion, goes to waste every year. Solving this pervasive crisis has become an industry imperative that is being tackled through a variety of innovative technologies to improve shelf-life, dynamically adjust pricing based on sell-by dates, and allow restaurants to automatically monitor their daily waste.

In the food manufacturing sector, digitally-connected supply chain systems are providing greater visibility into the production of foods and beverages. Supplier management technology delivers data that can be used to optimize processes and improve quality in real-time, making it easy to adjust to consumer demands, respond to logistics challenges, and boost government compliance. The enhanced operational benefits offered through improved supply chain visibility allows manufacturers to produce products faster, safer, and with greater transparency.

Online ordering has also ushered in a new era of food industry behavior. The growing assortment of online ordering apps has just given the consumer more control over quickly ordering their next meal. The trend in online ordering has also allowed restaurants to experiment with new business models like virtual kitchens that offer menus that are only available online.

IoT: The Future of Food Safety

From the farm to the carryout bag, the impact of technology on the greater food industry is already evident in daily practice. Through enhanced access to data, food producers can run an efficient supply chain that reduces waste, boosts productivity, and meets consumer demand in real-time. Using a variety of online resources, consumers are empowered to quickly make well-informed food purchases that are healthier, more convenient and more sustainable than ever before.

The Internet-of-Things (IoT) adds a layer of technology to the food manufacturing process to ensure greater food safety. A broad series of networked sensors, monitors, and other Internet-connected devices, IoT technology can oversee the entire food manufacturing and distribution process from the warehouse to the point of sale. Boosting transparency across the board, intelligent sensors and cameras can transform any food manufacturing operation into a highly visible, data-backed process that allows for better decision-making and improved real-time knowledge.

While IoT technology is a powerful tool that can improve the efficiency of restaurants and provide enhanced customer experiences, some of its greatest potential lies in its ability to safely monitor food preparation and production. Live data from IoT devices makes it possible to closely monitor food safety data points, allowing manufacturers and restaurants to reduce the risks of foodborne illness outbreaks through enhanced data collection and automated reporting.

Domino’s Pizza, for instance, embraced IoT technology to enhance management processes and monitor the food safety of its products. In the past, restaurants have relied on workers to record food temperatures, a practice that was occasionally overlooked and could lead to issues with health inspectors. Using IoT devices for real-time temperature monitoring, Domino’s automatically records and displays temperature levels of a store’s production, refrigeration, and exhaust systems, allowing employees to view conditions from a live dashboard.

In addition to boosting food safety, the comprehensive monitoring offered by IoT technology can help food companies reduce waste, keep more effective records, and analyze more data for improved operations.

IoT isn’t just a safe solution for improving food safety: It’s a smart solution.

Blockchain: The Future of Food Traceability

The ubiquity of QR codes has made it easy for consumers to quickly gain access to information by scanning an image with their smartphone. From accessing product manuals to downloading songs, QR codes make it simple to provide detailed and relevant content to users in a timely manner.

Blockchain technology provides a powerful opportunity to provide consumers with similar information about food safety. Able to instantaneously trace the lifecycle of food products, blockchain can report a food’s every point of contact throughout its journey from farm to table. By scanning a QR code, for instance, users can quickly access relevant information about a food product’s source, such as an animal’s health, and welfare. Shoppers at Carrefour, Europe’s largest retailer, area already using blockchain traceability to track the stage of production of free-range chickens across France.

Walmart piloted a blockchain implementation by tracing a package of sliced mangoes across every destination until it hit store shelves, from its origin at a farm in Mexico to intermittent stops at a hot-water treatment plant, U.S processing plant, and cold storage facility. Real-time product tracing can be conducted in just two seconds, enabling Walmart and other vendors to provide consumers with access to food safety information that could easily be updated should an outbreak or contamination occur.

Blockchain’s inherent transparency not only makes it possible to identify the safety of food production; it also enhances the safety of the business of food production itself. Because blockchain is based upon an immutable, anonymous ledger, record keeping and accounting can be made more secure and less prone to human error. Payments to farmers and other food suppliers can also become more transparent and equitable.

The High Tech Future of Food

Unlike the days of Sinclair’s The Jungle, food transparency is the name of today’s game. As consumers continue to demand greater access to better food on-demand, food producers must continue to find innovative ways of providing safe, healthy, and ethical solutions.

IoT devices and blockchain present food manufacturers with powerful technological solutions to solve complex problems. Brands choosing to rely on these innovations, such as Domino’s and Walmart, are helping ensure that food is produced, prepared and distributed with a foremost emphasis on health and safety. As these technologies continue to become more intelligent, well-connected, and embraced by leading food producers, consumers should rest assured that they’ll always be able to know exactly what they’re eating, where it’s from, and whether it’s safe.