After two years of COVID-19—and now an escalating Russia-Ukraine conflict—the failing supply chain is a pressing concern in the food industry. Exacerbating the supply chain issues is our excessive food waste problem. As supplies become more difficult and expensive to secure, we should be focusing more attention on reducing waste. Food businesses that proactively work to reduce food waste will save significant money, meet corporate sustainability goals and help the planet.

Food waste is estimated at between 30-40% of the U.S. food supply, which equates to an astonishing 133 billion pounds and $161 billion in waste, according to the USDA. In addition to discarded food, there is also considerable waste of labor, energy and other resources that go into producing, processing, transporting, prepping, cooking, storing and disposing of unused food.

Food waste occurs for many reasons, including:

- Spoilage at every stage of the supply chain

- Problems like mold or bacteria during harvesting, transporting, processing, etc.

- Damage by insects, rodents, and other pests.

- Equipment malfunction (such as faulty walk-in coolers).

- Improper storage (e.g., not holding foods at proper temperatures).

- Over-ordering, over-prepping, or cooking more than what’s needed, and tossing out the extras.

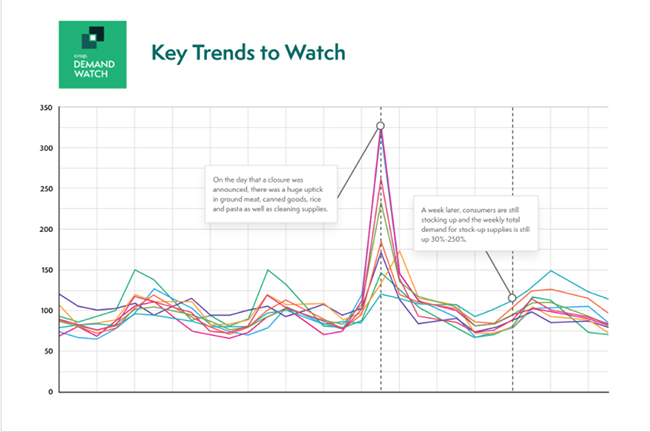

Many food businesses inadvertently practice wasteful behaviors. This is due, in large part, to the lack of accurate, comprehensive data. If operators don’t have accurate data about their inventory, sales patterns and forecasts, it can lead to food waste, which can be costly to your business and damaging to our planet.

At a time when every dollar counts—and the supply chain is strained—your organization should proactively work to reduce food waste. The following are some effective ways to accomplish this goal.

- Adopt the right software. Integrated software is the best solution to eliminate wasted food, money and other resources. Today’s systems allow organizations to view sales patterns, track inventory, manage production, avoid overstocking, enhance food safety and quality, and determine areas of wastage. Tech solutions allow organizations to use data—not instincts—to make better, more profitable, less wasteful decisions.

- Conduct a food waste audit. Food waste is bad for the environment as well as business margins. A food waste audit can help a company determine how much food is being wasted, as well as the type of foods not being used effectively. This practice can help companies address waste problems and adjust their inventory accordingly.

- Implement sustainable strategies. It’s problematic—and wasteful—when retail locations receive large quantities of fresh foods and can’t sell it all before it spoils. Hannaford Supermarkets found a solution to this common conundrum. They have their trucks deliver smaller amounts of food more frequently—versus less frequent, higher volume deliveries. As a result, they are selling fresher produce with less waste.

- Make waste reduction part of company culture. Train staff to reduce waste, and properly use, cook, package and store foods while always prioritizing waste reduction. Adopt a waste-not-want-not mindset and follow sustainable strategies that are practiced starting in the C-suite.

- Donate surplus food. After learning that billions of pounds of food goes to waste in the United States while millions of people are going hungry, entrepreneur Jasmine Crowe created Goodr, a food waste management company that connects food businesses with a surplus of supplies to non-profit organizations that give it to the food insecure. Additionally, grocery chain Trader Joe’s is well-known for their generous food donation program. In just one year, the company donated $295 million worth of their unused products to food banks, feeding the hungry and eliminating a huge amount of waste.

- Improve packaging. Our industry must create better packaging that effectively protects and preserves food throughout the entire supply chain cycle—and helps reduce waste. For instance, companies are experimenting with more compostable packaging, clearer use-by/expiration dates, easier-to-understand usage instructions, tips for storing leftovers, and ways to use some of the food without compromising the rest of the food in the package.

- Reconsider portion size. Some restaurants offer smaller meals (i.e., half portions) to reduce waste. Food manufacturers are also providing smaller options, such as the single-serving Duncan Hines Perfect Size Cakes for customers who want just a small treat without having to waste an entire cake. Sabra Singles hummus, Good Culture cottage cheese, Kraft Mac and Cheese and other companies offer single serving containers, which means less waste.

- Use every scrap. Vegetable peels, eggshells, coffee grounds, tea bags and other non-meat scraps can be used for compost, which is nutrient-rich and will go back into the earth to grow more food. Use the compost to grow your own herbs and produce or share it with local farmers and gardeners.

- Consider other eco-friendly options. Sustainable organizations are taking our food scraps and recycling them into bioenergy, bioplastics and clothing. Investigate eco-friendly organizations in your area and donate your unused food to them to repurpose it. For instance, H&M’s Conscious collection uses silk-like fabric made from citrus juice by-products and discarded orange peels. Other clothing lines, cosmetics companies and other innovators are making sustainable products from food waste.

It is important to recognize that the food industry’s waste isn’t limited solely to food. The following are some additional eco-friendly practices that companies can implement.

- Reduce plastic waste. Americans produce a whopping 42 million tons of plastic waste annually. Increasingly, companies are looking for eco-friendlier options. Footprint, a materials science company, is inventing and manufacturing plant-based solutions to replace plastic. This innovative company is working with food companies—including McDonalds, Costco and Conagra—to adopt plant-based solutions, eliminate short-term use plastic, reduce CO2 emissions, cut landfill waste, and reach corporate sustainability goals. Stonyfield Farm, known for their planet-friendly business practices, is making their yogurt cups from plants. In fact, the market for edible packaging is on the rise, and expected to grow by almost 5% by 2030. A growing number of food businesses are now relying on biodegradable and compostable packaging solutions instead of plastic. Are you one of them?

- Pick the right partners. Select partners (e.g., suppliers, vendors, etc.) that are also focused on sustainability. Digital solutions can easily track supplier certifications to ensure that you’re sourcing from—and collaborating with—other companies that are committed to waste reduction and other eco-friendly business practices.

- Focus on sustainability. It takes considerable energy to run equipment non-stop, so shut down non-essential equipment during slow times to save energy and money. Also, insulate your hot water pipes to decrease the amount of water your organization uses (and lower your heating needs and costs). Turn off the air conditioning and open windows. Use silverware instead of plasticware, and reusable towels instead of paper. Think of different ways to reduce waste throughout your organization and you’ll save money, resources, and the environment.

Prioritize waste reduction using these proven strategies. Remember that every little bit helps, and even the smallest changes will add up to a substantial difference over time.