The third-party logistics provider (3PL) market is expected grow at a compound annual growth rate of more than 5% through at least 2024, according to Hexa Research. In addition, Aberdeen Research reports that industry leaders have increased the number of 3PLs they work with by more than 20% since 2013. Clearly, companies are outsourcing more of their logistics activities, and there are many factors to consider when choosing a 3PL, especially in the food industry. This article discusses a few essentials to take into account before betting your company reputation on a new 3PL relationship.

1. Experience

Transporting food is a serious and complex business, and it’s one place you don’t want to be a trailblazer. If the 3PL you’re considering doesn’t have extensive experience with products similar to yours, you are better off looking elsewhere. After all, it’s your reputation that will take the hit if things go wrong. This is one area where it pays to check references.

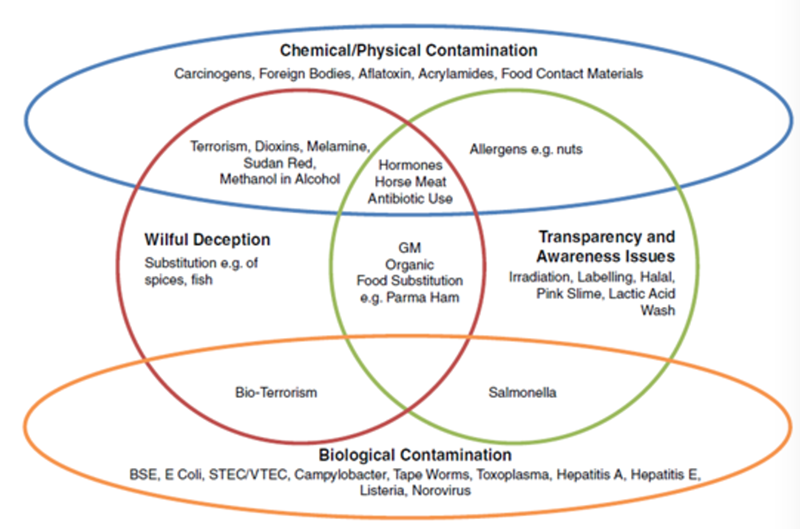

A company’s supply chain can be the weakest link in its food safety program. Learn how to mitigate these risks at the Food Safety Supply Chain conference | June 5-6, 20172. Familiarity With Food Safety

First and foremost, ensure your 3PL understands the ramifications of the latest legislation regarding food handling — including FSMA and HACCP. It should be able to point to material handling data sheets for every item of food it handles. Give the 3PL bonus points if it can personalize the handling instructions to each shipper.

Make sure the 3PL understands the rules in all the geographic areas where you ship, since local regulations can vary.

3. Certified Processes

FSMA requires specific documentation. The 3PL you choose should already be aware of the rules and have processes in place for compliance. It should have taken the initiative to have its processes audited for compliance. After all, compliance with regulations is part of the service it provides for you.

Ask the provider to show you its method for conveying handling instructions to carriers, and how it ensures that carriers follow the instructions. The burden of proof for cold-chain integrity or HACCP compliance falls to you, so don’t entrust your business to a 3PL that doesn’t understand it.

4. Track and Trace, Lot and Expiration Controls

Recalls happen. Your 3PL should have technology in place to provide visibility throughout the supply chain, including the ability to track and trace from end to end. Ask to see its picking process, and how it ensures first-in-first-out (FIFO) lot picking so you minimize spoilage. How does it handle expired or soon-to-expire lots? Can it segregate the goods so it doesn’t actually ship them? How does it notify you of upcoming expirations? Proactive alerting is the ideal mechanism.

5. Size and Locations

Once the 3PL you are considering has proven it understands how to handle food products safely and legally, the next step is to ensure it can provide the coverage you require. It should have offices in or near your distribution points. Ask to see the 3PL’s customer list. You don’t want to be much larger than its current largest customer because it may not be equipped to deal with your volumes. You also don’t want to be among its smallest shippers, because you may not get the attention you deserve.

Make sure the provider is fiscally sound, especially if you are entering this relationship for the long term.

6. Technology

Technology is fast becoming the biggest differentiator for a 3PL. Ask about the systems it uses for collaboration and visibility. Does it have automated picking capabilities? Are your business systems easily compatible if you want to integrate, or does it provide a shipper portal for 24/7 access? What are its future technology plans? A good 3PL should be excited to talk about its technology because it would know it’s a key differentiator. If the provider is reluctant to talk about it or lagging in the technology arena, it will not be a good long-term partner.

Your business depends on a great 3PL, and your customer’s health and safety may rely on it as well. Take the time to thoroughly vet any 3PL you are considering before signing on the dotted line.